How many hours do you have to work to pay for your mortgage? Driven by pent up pandemic demand and a stronger economy housing prices are climbing. In many markets homeowners receive multiple offers as soon as their homes go up for sale. In some cases they never even reach the open market. This is particularly tough on first time buyers. Besides issues of fairness and access, this raises the question of how much is too much? While most new graduates enter the renter’s market – their mortgage is their college loan payment – housing prices also impact rental prices. The rule of supply and demand.

Brief History

In the dim and distant past, when I first entered the ‘adult’ rather than the ‘college’ housing market, I was a 2nd lieutenant in the USAF. At that time military pay was quite a bit lower than civilian pay for similar work. While there were some tax advantages, housing pay was tax free, my take home net was about two-thirds that of my fellow grads. To be fair, I graduated with no debt, but even the most expensive colleges were significantly less costly back then. That said, paying the all inclusive rent for my 1 bedroom apartment in East Arlington, MA required nearly 60% of my monthly take home income. To put it another way, I worked around 130 hours each month to pay my rent.

The remaining 40% covered my car expenses, landline (no cell phones then), food, and entertainment. Because I had a complete set of uniform pieces from training, my clothing budget was near zero. Yes, on my off days I could pass for a poor college student, but I’ve never been particularly fashionable anyway.

Back to the Present

All right, so that’s nice, but what about now. First of all, I’m happy to say that congress has closed most of the gap between military and civilian pay. I suspect things are still tough for junior enlisted folks if they’re forced to live off base, but it’s certainly better. On the downside, college costs have exploded. Since my time tuition, fees, and room & board, have more than quadrupled. This is particularly the case for room & board where many schools require two or more years of on-campus housing. Unfortunately, starting salaries have only increased an average of two and a half times. Putting these two facts together creates quite a financial crunch for new graduates.

How much is too much for a Mortgage

According to Nerdwallet.com, a mortage (or rent) should follow the 28/36 rule. Meaning that your mortgage should be less than 28% of your income and 36% or less of your total debt. Using the first number, that implies about 60 hours of work to pay your mortgage. How reasonable is that? As with everything in real estate it comes down to location, location, location. Which of course brinfs us to our featured map courtesy of howmuch.com and zillow.

So while the trendiest coastal cities remain ridiculously high-priced for the average worker, much less the new graduate, the middle of the country offers many opportunities.

As always thanks for reading.

Armen

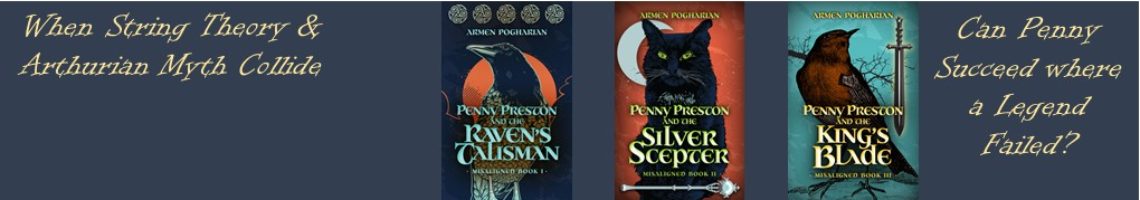

Note to Pay the Bills: While there are no plot points related to housing costs, the Misaligned series is set in the affordable Finger Lakes region of upstate NY. If you’ve ever wanted to learn how String Theory underpins Arthurian myth as part of a Young Adult fantasy series why not spend a minute or two learning more by reading a summary of the series here or find links to purchase books here.